Ensuring compliance and growth for your business

Automate processing of VAT, sales tax, income tax, and other complex calculations, with built-in support for multi-country reporting formats and e-invoice generation

Seamless process integration

Streamline workflows from data collection and tax determination to filing and payment, minimizing manual intervention

Dynamic regulatory updates

Track tax law changes in real time and auto-adjust compliance logic to mitigate delays

Proactive risk monitoring

Detect inconsistencies in filings through standardized validation rules and real-time anomaly alerts to minimize errors and audit

Unified tax data hub

Aggregate tax data from multiple entities and jurisdictions into one platform, enabling taxable profit tracking, and analytical report generation

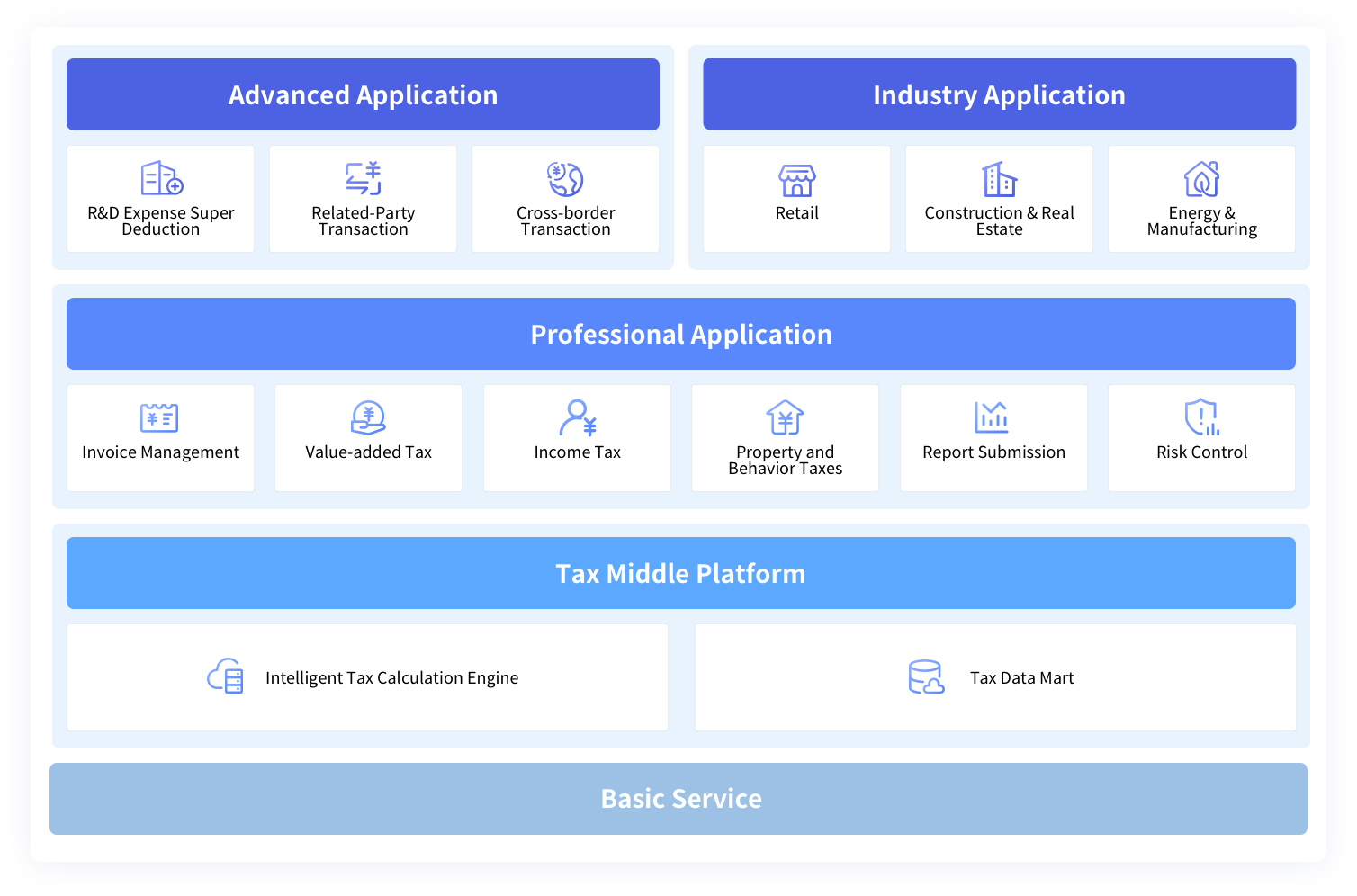

Innovative features of Kingdee Cloud Tax Management

AI-powered tax solution

Automating tax compliance and risk monitoring in real-time through a smart engine, while transforming multi-source data into actionable tax insights (burden/benchmark/trend analysis). AI-powered planning provides entity-specific tax calculation and optimization, delivering cross-industry efficiency gains and sustainable cost savings

Demo RequestWe make the vison of our customers come into reality

Discover Your Next Business Breakthrough with Kingdee

What are analysts saying about kingdee?

Ranked No.1 in enterprise application software market share in the tax segment

IDC: PRC Enterprise Application Software SaaS Market Tracking Report , 2023

Ranked No.1 in market share in China and the Top10 in the world in the field of high-productivity aPaaS platform

Gartner: Market Share: All Software Markets, Worldwide 2022

The only enterprise management SaaS cloud vendor in Wave AI/ML in China

Forrester: The Forrester Wave TM: AI/ML Platforms in China

Frequently asked questions

Consulting firms offer standardized methodologies to help enterprises design digital transformation frameworks and roadmaps. However, because internal management structures vary—especially in large organizations where process changes can be complex—fully implementing consulting recommendations may involve risks. We recommend contacting vendor consultants for on-site discussions and comprehensive evalsuations to ensure effective implementation.

Internal control and risk management are integral to end-to-end business operations, requiring a complete governance system that covers:

- Pre-Event Risk Avoidance

- In-Event Risk Mitigation

- Post-Event Risk Resolution

These tasks are necessary even without a system, although execution may be less streamlined. Before system implementation, enterprises should document pain points and lessons learned to guide system design, ensuring strategic and efficient development.

If risk management is overlooked before implementation, flexible systems allow retrospective evalsuation during or after deployment. Kingdee Cloud Tax Solution supports adaptable governance through its EBC-composable architecture, which enables:

- Foundational Functions (e.g., invoice management, tax calculation, filing)

- On-Demand Activation of risk control applications aligned with enterprise maturity.

Get a free demo right now

Discover how Kingdee can transform your business—ask about solutions, implementation, or pricing tailored to your needs.

+853 2853 3813

+853 2853 3813